The Conference Watch the recaps

About LoGRI Local knowledge to facilitate on-the-ground research and reform

Cities in the Global South need significant revenue to build infrastructure and provide local services. However, efforts to collect taxes, particularly on property, are often ineffective and inequitable. LoGRI supports governments to raise local revenue more fairly and in ways that promote trust, transparency and accountability.

We do this by:

- Partnering with governments to provide hands-on support and advice

- Conducting collaborative, applied research to inform reform projects

- Developing operational tools, including technology solutions

- Delivering skills training to develop local capacity

We also seek to share insights and shape policy by engaging with regional and international stakeholders on local public finance issues.LoGRI is based at the Munk School of Global Affairs &Public Policy and is an initiative of the International Centre for Tax and Development (ICTD).

Partners

We are proud to partner with the Intergovernmental Budget and Economic Council (IBEC) and the Kenya School of Revenue Administration (KESRA) to deliver LoGRI’s inaugural conference.

Intergovernmental Budget and Economic Council (IBEC)

The Intergovernmental Budget and Economic Council (IBEC) in Kenya serves as a platform for consultation and cooperation between the national government and county governments. Its main responsibilities include discussing budget-related documents, addressing economic and financial management matters, handling borrowing and loan guarantees, agreeing on fund disbursement schedules, reviewing legislation and regulations, making revenue distribution recommendations, and addressing other designated matters determined by the Deputy President in consultation with other Council members.

Kenya School of Revenue Administration (KESRA)

Kenya School of Revenue Administration (KESRA) is the Kenya Revenue Authority’s premier training school specializing in Tax and Customs Administration, Fiscal Policy and Management. The School is one of the only four World Customs Organization (WCO) accredited Regional Training Centres (RTCs) in Eastern and Southern Africa.

Agenda Three days of dialogue, a lifetime of collaboration

Many lower-income countries struggle to collect revenue from property taxes, with collection estimated at just ten percent of levels in wealthier nations.

Administrative limitations have led to regressive, inequitable systems that fail to link revenues to service delivery, resulting in low compliance rates. However, recent reform experiences have shown the potential of tailored strategies to strengthen property tax systems and promote progressive, equitable taxation. LoGRI’s inaugural conference will convene policymakers, researchers, and administrators to discuss lessons from these experiences about strengthening property taxation and local revenue systems.

Day One: June 13

Nairobi Serena Hotel

- 08:30 – 9:45

-

Registration & Coffee and Snacks

- 9:45 – 10:00

-

Official Opening & Introduction to LoGRI

Dr. Titilola Akindeinde, Executive Director, LoGRI & Dr. Colette Nyirakamana, Research Lead, LoGRI

- 10:00 – 10:15

-

Welcome Remarks

Rispah Simiyu, Ag. Commissioner General, Kenya Revenue Authority

- 10:15 – 10:30

-

Welcome Remarks

H.E. Johnson A. Sakaja, Governor of Nairobi City County

- 10:30 – 10:40

-

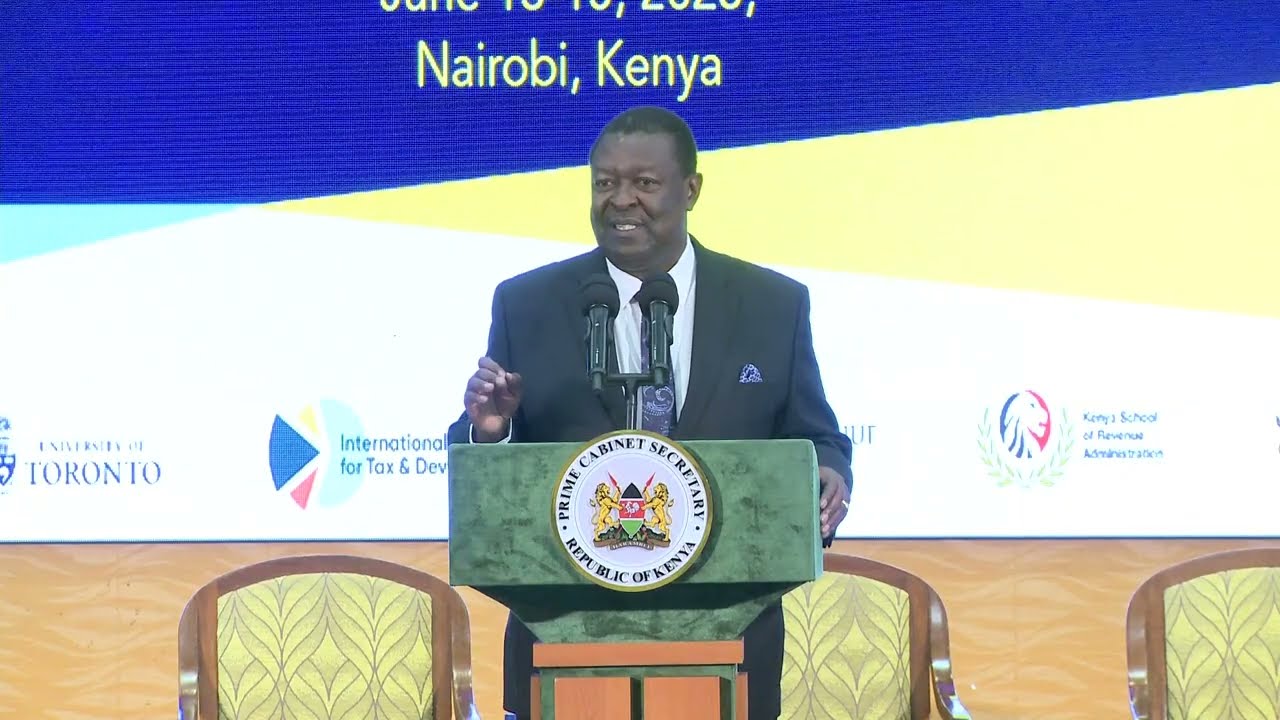

Opening Address

H.E. Rigathi Gachagua, Deputy President of Kenya

- 10:40 – 12:10

-

Description

Property taxes can significantly contribute to local development and help governments fund essential services. This is especially vital in cities facing population growth and the impacts of Covid-19. Property taxes contribute up to 50 percent of local revenues in high-income countries. However, in lower-income countries, they represent only up to 20 percent of income or one percent of GDP. Despite their potential, property taxes are often under-utilized. This plenary will discuss the importance of property taxation, the challenges preventing governments from realizing its full potential, and the benefits of implementing reform approaches tailored to local contexts.

Moderator

Dr. Riel Franzsen Director, African Tax Institute, South Africa Panelists

Jean Claude Mondo Head of the Tax Cadastre Project, Directorate General of Taxation, Cameroon Astrid Haas Urban Economist and Consultant H.E. Kawira Mwangaza Governor of Meru County H.E. Paul Simba Arati Governor of Kisii County - 12:10 – 13:30

-

Lunch

- 13:30 – 15:00

-

Description

Property tax systems in many lower-income countries have not performed well, but several countries are taking action to reverse this trend. Reforms can come in many forms, from big changes to the whole system to small improvements to specific aspects like property identification, valuation, or reliance on information technology systems and effective payment systems. This panel will discuss what makes these reforms successful, what challenges reformers face, and what we can learn from their successes and failures. Discussants will also explore how various reform innovations can be adapted to different situations.

Moderator

Dr. Nara Monkam Associate Professor, University of Pretoria, South Africa Panelists

Dr. Wilson Prichard

ICTD Executive Director, LoGRI Chair, Associate Professor at the University of Toronto, Canada

Dr Wilson Prichard is an Associate Professor at the University of Toronto’s Munk School of Global Affairs and Public Policy and Department of Political Science, a Research Fellow at the Institute of Development Studies, Executive Director of the ICTD and Chair of the LoGRI program. His research focuses on the political economy of tax reform in lower-income countries and the relationship between taxation and citizen demands for improved governance in Sub-Saharan Africa. He is the authors of Taxation, Responsiveness and Accountability in Sub-Saharan Africa: The Dynamics of Tax Bargaining (Cambridge University Press, 2015), Taxing Africa: Coercion, Reform and Development (Zed Press, 2018) and Innovations in Tax Compliance: Building Trust, Navigating Politics and Tailoring Reform (World Bank, 2022), along with a range of academic articles.

Rosetta Wilson Sierra Leone Project Lead, LoGRI Robert Nowere Director of Revenue Collection, Kampala Capital City Authority, Uganda - 15:00 – 15:30

-

Tea Break

- 15:30 – 17:00Parallel Sessions

-

Description

The registration of properties for property taxation historically happens in two stages: first, the property and owner are officially registered in a national cadastre, and then the properties are registered for property tax purposes. However, this two-stage process often leads to incomplete coverage of properties for taxation. Many properties end up unregistered, and often land and tax authorities do not share data, which can result in information gaps and inconsistencies. Consequently, these shortcomings can create problems of tax fairness and justice while undermining citizens’ trust in their local or tax authority. This session will discuss these challenges and explore reform strategies to improve property identification.

Moderator

Dr. Lucky Kabanga Lecturer, Mzuzu University, Malawi Panelists

Evan Trowbridge

Technical Lead, LoGRI

Evan advances LoGRI’s work through the collection, analysis, and management of data. Before joining the LoGRI team in Sierra Leone, he was the data manager at a local research organization. Evan’s prior experience includes four years of governance experience in Honduras, where he worked for USAID and a local NGO while also leading a small program for at-risk youth. His other work includes the International Innovation Corps and an association of philanthropic foundations. Evan has a Master of Public Policy from the University of Chicago Harris School of Public Policy and undergraduate degrees from Penn State University.

Hon. Jim Mukenge Minister of Economy, Kasai Central, Democratic Republic of Congo Lamine Badjie Deputy Director of Services & Head of Geographic Information Systems, Kanifing Municipal Council, the Gambia Description

Property valuation is a critical step in determining the value of properties for tax purposes and the distribution of the tax burden to ensure fairness and progressivity. However, it is not easy to do this in practice. The methods used to assess property value are often complex, expensive, and subjective, thus making it hard to value properties accurately, especially in lower-income countries. As a result, valuation rolls are often outdated and incomplete and often lead to lower property tax revenue for governments and unfairness taxation for taxpayers. In this session, speakers will discuss the reasons behind ineffective property valuation and approaches to improve outcomes.

Moderator

Rosetta Wilson Sierra Leone Project Lead, LoGRI Panellists

Nicolas Orgeira Pillai

Technical Lead, LoGRI

Nicolas Orgeira Pillai is a Doctoral Fellow with LoGRI. His research focuses on local revenue mobilisation, with a particular interest in property taxation and tax compliance. Through the use of impact evaluation approaches and quantitative analysis, his work aims to support tax administrations in implementing state-building tax reforms that improves governance and the relationship between the government and the citizens. His projects also relate to tax administration, gender and taxation, and the informal economy. He holds a master’s in economics at the University of Toronto and is a doctoral candidate in Economics at the University of Sussex.

Bilal Choho Research Coordinator Paris School of Economics, France Sitsopé Kounetsron Head of Section Land Security and Contradictory Demarcation, Office Togolais des Recettes, Togo - From 18:30

-

Dinner

Day Two: June 14

Nairobi Serena Hotel

- 08:30 – 09:30

-

Registration

- 09:30 – 09:35

-

Agenda Overview

- 09:35 – 11:05

-

Description

Information Technology (IT) systems can help improve property taxation in lower-income countries. New technologies can simplify property identification, automate aspects of property valuation, facilitate payments, and strengthen data management. However, IT systems often fall short of their potential or fail altogether. This plenary will discuss the dynamics of implementing IT systems for property tax reform and share experiences and strategies to optimize the use of these systems.

Moderator

Dr. Wilson Prichard

ICTD Executive Director, LoGRI Chair, Associate Professor at the University of Toronto, Canada

Dr Wilson Prichard is an Associate Professor at the University of Toronto’s Munk School of Global Affairs and Public Policy and Department of Political Science, a Research Fellow at the Institute of Development Studies, Executive Director of the ICTD and Chair of the LoGRI program. His research focuses on the political economy of tax reform in lower-income countries and the relationship between taxation and citizen demands for improved governance in Sub-Saharan Africa. He is the authors of Taxation, Responsiveness and Accountability in Sub-Saharan Africa: The Dynamics of Tax Bargaining (Cambridge University Press, 2015), Taxing Africa: Coercion, Reform and Development (Zed Press, 2018) and Innovations in Tax Compliance: Building Trust, Navigating Politics and Tailoring Reform (World Bank, 2022), along with a range of academic articles.

Panellists

Xaver Schenker

Technical Advisor and Consultant, LoGRI

Xaver is an independent technical expert who has been collaborating and leading on a variety of projects with LoGRI. After his MSc. in Economics at the Nova School of Business and Economics in Lisbon, he worked at a Research and Knowledge Center for Development Economics on projects in Guinea-Bissau and Angola. Subsequently, Xaver joined ICTD and went on to lead the property tax reform in Freetown, Sierra Leone, while conducting a variety of other consultancies with regards to local government revenue reforms across the globe. In his role as an independent technical consultant he continues to collaborate with LoGRI and other stakeholders on a number of reform projects and other consultancies.

Mor Fall Technical Advisor, Directorate General of Taxation and Domains, Senegal Géraud Tossou Direction des Services Informatiques, Direction Générale des Impôts du Bénin - 11:05 – 11:40

-

Tea/Coffee Break

- 11:40 – 13:10Parallel sessions

-

Description

When tax compliance is low, local governments need a clear, rules-based, and effective way to pursue enforcement action against noncompliant taxpayers. Without this, efforts to improve tax collection are unlikely to succeed. Governments often rely on enforcement to get more revenue and reduce payment arrears. However, enforcement efforts can be ineffective due to limited resources, political interference, and selective targeting. In turn, this can undermine the legitimacy of local authorities and make citizens lose trust in government. This session will focus on the challenges of enforcing property taxes and approaches to encourage voluntary compliance.

Moderator

Dr. Dan Ngabirano Lecturer, Makerere University, Uganda Panellists

Dr. Oyebola Okunogbe Economist, World Bank Development Research Group, World Bank, Liberia Dr. Jonathan Weigel Assistant Professor, University of California Berkeley, United States of America Shaban Asman Deputy Chief Revenue Officer, Nairobi City Council, Kenya Description

Property tax administration is often divided between central and local authorities, unlike other local revenue sources. Central governments usually oversee land titling, cadastral plans, and property valuation, while local governments handle rate setting, billing, payment, and enforcement. However, the split of responsibilities can be unclear due to incoherent rules and regulations. Moreover, effective property taxation requires strong collaboration between the two levels of government, but this is often lacking in practice, hindering reform efforts. This session will discuss the importance of and challenges to effective intergovernmental collaboration and explore critical areas of collaboration to improve outcomes.

Moderator

Dr. Colette Nyirakamana

Research Lead, LoGRI

Dr. Colette Nyirakamana is Research Lead for the LoGRI program, and Senior Research Associate at the Munk School of Global Affairs and Public Policy at the University of Toronto. Prior to joining LoGRI, Colette worked as program lead of the African Property Tax Initiative (APTI) at the International Centre for Tax and Development, where she was in charge of supporting APTI-funded researchers, leading research projects, engaging with key stakeholders and advising governments in the design of property tax reform efforts. Her research focuses on local finances with particular emphasis on the administrative, institutional and political factors that create favourable and unfavourable conditions for effective revenue mobilization. Dr. Nyirakamana holds a doctoral degree in Comparative Public Policy from McMaster University.

Panellists

Camille Barras

Policy Lead, LoGRI

Camille Barras is the Policy Lead for the Local Government Revenue Initiative (LoGRI). Her areas of work and interest encompass public governance and administration, subnational governance, intergovernmental relations and state-society relations – and their connection with taxation. She is also interested in questions related to the effectiveness and evolution of international development as a field, in evidence generation and uptake as well as in research methods (quantitative, mixed, evaluation). She completed, in 2023, a PhD at the University of Cambridge, investigating the effects of decentralization on political attitudes and behaviours, and holds academic qualifications in political science, public policy and law. Previously, she worked during seven years at the intersection of practice and research, mainly in the international development sector across a variety of organizations and projects in West/North Africa, South/East Asia and Europe. Among others, she worked for a local governance project at UNDP, was a project manager for impact evaluations at the Center for Evaluation and Development and consulted for the Swiss Agency for Development and Cooperation.

Annastaciah Githuba Deputy Commissioner, Kenya Revenue Authority, Kenya Dr. Damas Hounsounon Director of the Reform Monitoring Unit, General Taxation, Benin - 13:10 – 14:30

-

Lunch

- 14:30 – 16:00

-

Description

To strengthen property tax systems, it is important to not only build technical and technological capacity but also public and political support. Reforms need public support to restore citizens’ trust in public financial management and increase tax compliance. Similarly, success depends on the willingness and commitment of key political actors to support reform and overcome any political resistance. Although these aspects are crucial in designing reform models and strategies, they are often not well-researched or discussed in policy circles. This session will focus on strategies to build public and political support, drawing on research and reform experiences.

Moderator

Astrid Haas Urban Economist and Consultant Panellists

Dr. Abraham Rugo Country Manager, International Budget Partnership Kenya

Dr. Colette Nyirakamana

Research Lead, LoGRI

Dr. Colette Nyirakamana is Research Lead for the LoGRI program, and Senior Research Associate at the Munk School of Global Affairs and Public Policy at the University of Toronto. Prior to joining LoGRI, Colette worked as program lead of the African Property Tax Initiative (APTI) at the International Centre for Tax and Development, where she was in charge of supporting APTI-funded researchers, leading research projects, engaging with key stakeholders and advising governments in the design of property tax reform efforts. Her research focuses on local finances with particular emphasis on the administrative, institutional and political factors that create favourable and unfavourable conditions for effective revenue mobilization. Dr. Nyirakamana holds a doctoral degree in Comparative Public Policy from McMaster University.

Abou Bakarr Kamara Country Economist, International Growth Center, Sierra Leone - 16:00 – 16:15

-

Summary of Key Messages

Dr. Wilson Prichard, ICTD Executive Director, LoGRI Chair, Associate Professor at the University of Toronto, Canada

- 16:15 – 16:30

-

Concluding Remarks

Dr. Titilola Akindeinde, Executive Director, LoGRI

- From 18:30

-

Dinner

Day Three:

June 15

Optional Technical Workshops:

Sarova Panafric Hotel

- 9:00 – 10:45

-

Description

Comprehensive and up-to-date maps of taxable properties and clear addressing systems are crucial for effective property taxation. Outdated or incomplete maps lead to unaccounted properties, hindering revenue collection and fairness. Unclear addressing systems create difficulties in updating property information, delivering bills, and ensuring compliance. The LoGRI program explores simplified property identification models, including satellite mapping, simplified registration, addressing system simplification, and technology utilization. This session will address challenges, present implementation examples, and discuss the benefits, drawbacks, and alternatives of this approach.

Workshop Leaders

Dr. Wilson Prichard

ICTD Executive Director, LoGRI Chair, Associate Professor at the University of Toronto, Canada

Dr Wilson Prichard is an Associate Professor at the University of Toronto’s Munk School of Global Affairs and Public Policy and Department of Political Science, a Research Fellow at the Institute of Development Studies, Executive Director of the ICTD and Chair of the LoGRI program. His research focuses on the political economy of tax reform in lower-income countries and the relationship between taxation and citizen demands for improved governance in Sub-Saharan Africa. He is the authors of Taxation, Responsiveness and Accountability in Sub-Saharan Africa: The Dynamics of Tax Bargaining (Cambridge University Press, 2015), Taxing Africa: Coercion, Reform and Development (Zed Press, 2018) and Innovations in Tax Compliance: Building Trust, Navigating Politics and Tailoring Reform (World Bank, 2022), along with a range of academic articles.

Evan Trowbridge

Technical Lead, LoGRI

Evan advances LoGRI’s work through the collection, analysis, and management of data. Before joining the LoGRI team in Sierra Leone, he was the data manager at a local research organization. Evan’s prior experience includes four years of governance experience in Honduras, where he worked for USAID and a local NGO while also leading a small program for at-risk youth. His other work includes the International Innovation Corps and an association of philanthropic foundations. Evan has a Master of Public Policy from the University of Chicago Harris School of Public Policy and undergraduate degrees from Penn State University.

- 10:45 – 11:00

-

Tea/Coffee Break

- 11:00 – 12:45

-

Description

Ensuring accurate property valuation is crucial for equitable property tax systems and revenue stability. However, outdated valuations often fail to reflect actual property values. To address this, the LoGRI program has explored simplified approaches, such as the “points-based approach.” This approach estimates property size, collects observable property characteristics as proxies for value, involves expert valuers for market/rental value estimates, and builds a simple model for determining taxable value. It offers greater equity and transparency compared to area-based systems and expensive expert-driven models. This session will discuss valuation challenges, present implementation examples, and invite discussion on the advantages, drawbacks, and alternatives of this approach.

Workshop Leaders

Dr. Wilson Prichard

ICTD Executive Director, LoGRI Chair, Associate Professor at the University of Toronto, Canada

Dr Wilson Prichard is an Associate Professor at the University of Toronto’s Munk School of Global Affairs and Public Policy and Department of Political Science, a Research Fellow at the Institute of Development Studies, Executive Director of the ICTD and Chair of the LoGRI program. His research focuses on the political economy of tax reform in lower-income countries and the relationship between taxation and citizen demands for improved governance in Sub-Saharan Africa. He is the authors of Taxation, Responsiveness and Accountability in Sub-Saharan Africa: The Dynamics of Tax Bargaining (Cambridge University Press, 2015), Taxing Africa: Coercion, Reform and Development (Zed Press, 2018) and Innovations in Tax Compliance: Building Trust, Navigating Politics and Tailoring Reform (World Bank, 2022), along with a range of academic articles.

Nicolas Orgeira Pillai

Technical Lead, LoGRI

Nicolas Orgeira Pillai is a Doctoral Fellow with LoGRI. His research focuses on local revenue mobilisation, with a particular interest in property taxation and tax compliance. Through the use of impact evaluation approaches and quantitative analysis, his work aims to support tax administrations in implementing state-building tax reforms that improves governance and the relationship between the government and the citizens. His projects also relate to tax administration, gender and taxation, and the informal economy. He holds a master’s in economics at the University of Toronto and is a doctoral candidate in Economics at the University of Sussex.

- 12:45 – 14:00

-

Lunch

- 14:00 – 15:45

-

Description

Digitalization has the potential to revolutionize property tax administration, but often falls short due to various reasons like poor system design, high costs, lack of technical support, data sharing challenges, political opposition, and administrative resistance. This session will address system design challenges, including participant experiences, principles and technical requirements, and a demonstration of the IT system in Freetown, Sierra Leone. The discussion will provide an opportunity to revisit key messages, address challenges, and explore potential strategies.

Workshop Leaders

Dr. Wilson Prichard

ICTD Executive Director, LoGRI Chair, Associate Professor at the University of Toronto, Canada

Dr Wilson Prichard is an Associate Professor at the University of Toronto’s Munk School of Global Affairs and Public Policy and Department of Political Science, a Research Fellow at the Institute of Development Studies, Executive Director of the ICTD and Chair of the LoGRI program. His research focuses on the political economy of tax reform in lower-income countries and the relationship between taxation and citizen demands for improved governance in Sub-Saharan Africa. He is the authors of Taxation, Responsiveness and Accountability in Sub-Saharan Africa: The Dynamics of Tax Bargaining (Cambridge University Press, 2015), Taxing Africa: Coercion, Reform and Development (Zed Press, 2018) and Innovations in Tax Compliance: Building Trust, Navigating Politics and Tailoring Reform (World Bank, 2022), along with a range of academic articles.

Evan Trowbridge

Technical Lead, LoGRI

Evan advances LoGRI’s work through the collection, analysis, and management of data. Before joining the LoGRI team in Sierra Leone, he was the data manager at a local research organization. Evan’s prior experience includes four years of governance experience in Honduras, where he worked for USAID and a local NGO while also leading a small program for at-risk youth. His other work includes the International Innovation Corps and an association of philanthropic foundations. Evan has a Master of Public Policy from the University of Chicago Harris School of Public Policy and undergraduate degrees from Penn State University.

Xaver Schenker

Technical Advisor and Consultant, LoGRI

Xaver is an independent technical expert who has been collaborating and leading on a variety of projects with LoGRI. After his MSc. in Economics at the Nova School of Business and Economics in Lisbon, he worked at a Research and Knowledge Center for Development Economics on projects in Guinea-Bissau and Angola. Subsequently, Xaver joined ICTD and went on to lead the property tax reform in Freetown, Sierra Leone, while conducting a variety of other consultancies with regards to local government revenue reforms across the globe. In his role as an independent technical consultant he continues to collaborate with LoGRI and other stakeholders on a number of reform projects and other consultancies.

The People of LoGRI

Chair

Dr. Wilson Prichard

Chair

Dr Wilson Prichard is an Associate Professor at the University of Toronto’s Munk School of Global Affairs and Public Policy and Department of Political Science, a Research Fellow at the Institute of Development Studies, Executive Director of the ICTD and Chair of the LoGRI program. His research focuses on the political economy of tax reform in lower-income countries and the relationship between taxation and citizen demands for improved governance in Sub-Saharan Africa. He is the authors of Taxation, Responsiveness and Accountability in Sub-Saharan Africa: The Dynamics of Tax Bargaining (Cambridge University Press, 2015), Taxing Africa: Coercion, Reform and Development (Zed Press, 2018) and Innovations in Tax Compliance: Building Trust, Navigating Politics and Tailoring Reform (World Bank, 2022), along with a range of academic articles.

Executive Director

Dr. Titilola Akindeinde

Executive Director

Dr. Titilola Akindeinde has over 20 years of experience in Economic Policy and Strategy in the UK and Nigeria. She has a proven track record as a UK government economist, a consultant providing technical support to the Government of Nigeria, and as Team Leader/Programme Manager implementing FCDO funded Policy Development Facility (PDF) programmes, where she demonstrated success in leadership, programme management, strategic thinking and engagement, analytical decision making, economic analysis, and policy and strategy development. She has led teams and consultants in economic and governmental interventions and communicated the results effectively to various stakeholders and audiences.

Dr. Akindeinde has a highly developed political awareness, understanding of economic policies and growth, and wide-reaching networks through her experience working at a high level within government. This awareness underscores her ability to use political judgement and sensitivity in managing relationships with senior government and private sector actors as evidenced in her leadership of PDF.

Program Director

Moyo Arewa

Program Director

Moyo is a researcher, policy professional, and program manager currently serving as the Program Director for the Local Government Revenue Initiative (LoGRI). In this capacity, he oversees all aspects of LoGRI’s research and advisory operations and provides strategic support to LoGRI’s Executive Director and Chair. He was previously the Manager for Strategic Initiatives at the International Centre for Tax and Development and, before then, a Policy Development Officer at the City of Toronto. His research has focused on understanding how digital technologies impact tax policy, administration, and public service delivery.

He has a wealth of experience using his management, engagement, and research skills to address policy, governance, and administrative challenges. Moyo received his master’s degree from the Munk School of Global Affairs and Public Policy.

Research Lead

Dr. Colette Nyirakamana

Research Lead

Dr. Colette Nyirakamana is Research Lead for the LoGRI program, and Senior Research Associate at the Munk School of Global Affairs and Public Policy at the University of Toronto. Prior to joining LoGRI, Colette worked as program lead of the African Property Tax Initiative (APTI) at the International Centre for Tax and Development, where she was in charge of supporting APTI-funded researchers, leading research projects, engaging with key stakeholders and advising governments in the design of property tax reform efforts. Her research focuses on local finances with particular emphasis on the administrative, institutional and political factors that create favourable and unfavourable conditions for effective revenue mobilization. Dr. Nyirakamana holds a doctoral degree in Comparative Public Policy from McMaster University.

Policy Lead

Camille Barras

Policy Lead

Camille Barras is the Policy Lead for the Local Government Revenue Initiative (LoGRI). Her areas of work and interest encompass public governance and administration, subnational governance, intergovernmental relations and state-society relations – and their connection with taxation. She is also interested in questions related to the effectiveness and evolution of international development as a field, in evidence generation and uptake as well as in research methods (quantitative, mixed, evaluation). She completed, in 2023, a PhD at the University of Cambridge, investigating the effects of decentralization on political attitudes and behaviours, and holds academic qualifications in political science, public policy and law. Previously, she worked during seven years at the intersection of practice and research, mainly in the international development sector across a variety of organizations and projects in West/North Africa, South/East Asia and Europe. Among others, she worked for a local governance project at UNDP, was a project manager for impact evaluations at the Center for Evaluation and Development and consulted for the Swiss Agency for Development and Cooperation.

Communications and Events Officer

Priyanka Shah

Communications and Events Officer

Priyanka is the Communications and Events Officer for the Local Government Revenue Initiative (LoGRI). In her current role, she is responsible for developing LoGRI’s engagement with external stakeholders, as well as managing its communications, events, outreach, and knowledge translation mandate.

With over five years of experience in the international development sector, Priyanka has held a variety of roles across communications, knowledge management, advocacy, and research. Prior to joining LoGRI, she worked with Health Systems Global (HSG), where she managed the their communications portfolio and played a key role in delivering the Seventh Global Symposium on Health Systems Research (HSR2022) in Bogota, Colombia. She has extensive experience working with grassroots and global organizations in grants funded by the BMGF, USAID, and the WHO. She holds a Bachelor of Arts (Honours) degree from the University of Delhi, and a Master’s degree in Conflict, Security, and Development from the University of Sussex.

Research Officer

Marie-Reine Mukazayire

Research Officer

Marie-Reine is a researcher and recent graduate from the Munk School of Global Affairs and Public Policy. In her studies, she specialized in Global Development and Global Justice. She is interested in the ways sub-Saharan francophone African states can build capacity to ensure better service delivery while facilitating human-centric sustainable growth.

Grants Administrator

Daniel Kawal

Grants Administrator

Daniel Kawal is the Grants Administrator for LoGRI. Daniel joined the Munk School of Global Affairs & Public Policy finance team in 2018 after graduating from the University of Toronto with a Bachelor of Commerce with distinction. He is a CPA and is currently enrolled in the Master of Forensic Accounting program at the University of Toronto.

Doctoral Fellow

Graeme Stewart-Wilson

Doctoral Fellow

Graeme Stewart-Wilson is a Ph.D. student in Political Science at the University of Toronto and a researcher with LoGRI. His research explores the links between local state building and tax reform in sub-Saharan Africa.

Doctoral Fellow

Nicolas Orgeira Pillai

Doctoral Fellow

Nicolas Orgeira Pillai is a Doctoral Fellow with LoGRI. His research focuses on local revenue mobilisation, with a particular interest in property taxation and tax compliance. Through the use of impact evaluation approaches and quantitative analysis, his work aims to support tax administrations in implementing state-building tax reforms that improves governance and the relationship between the government and the citizens. His projects also relate to tax administration, gender and taxation, and the informal economy. He holds a master’s in economics at the University of Toronto and is a doctoral candidate in Economics at the University of Sussex.

Doctoral Fellow

Sripriya Iyengar Srivatsa

Doctoral Fellow

Sripriya Iyengar Srivatsa is the Thematic Focal Point for Gender and Tax at the ICTD and a Doctoral Fellow at LoGRI. She is pursuing her PhD at University of Cambridge. Her research areas include political economy, state capacity, and gender, with a geographical focus on Sub-Saharan Africa and South Asia. Combining observational data and experimental methods, she specialises in analysing the roles of competing political institutions, state-society-land relations, and connections between intra-household dynamics and socioeconomic outcomes. She was an ODI Fellow at the Ministry of Finance in Sierra Leone from 2019-2021. She obtained her Master’s in Political Economy from SOAS, University of London.

Technical Lead

Evan Trowbridge

Technical Lead

Evan advances LoGRI’s work through the collection, analysis, and management of data. Before joining the LoGRI team in Sierra Leone, he was the data manager at a local research organization. Evan’s prior experience includes four years of governance experience in Honduras, where he worked for USAID and a local NGO while also leading a small program for at-risk youth. His other work includes the International Innovation Corps and an association of philanthropic foundations. Evan has a Master of Public Policy from the University of Chicago Harris School of Public Policy and undergraduate degrees from Penn State University.

Technical Consultant

Xaver Schenker

Technical Consultant

Xaver is an independent technical expert who has been collaborating and leading on a variety of projects with LoGRI. After his MSc. in Economics at the Nova School of Business and Economics in Lisbon, he worked at a Research and Knowledge Center for Development Economics on projects in Guinea-Bissau and Angola. Subsequently, Xaver joined ICTD and went on to lead the property tax reform in Freetown, Sierra Leone, while conducting a variety of other consultancies with regards to local government revenue reforms across the globe. In his role as an independent technical consultant he continues to collaborate with LoGRI and other stakeholders on a number of reform projects and other consultancies.

Technical and Policy Coordinator / Intern

Annette Olohime Umakhihe

Technical and Policy Coordinator / Intern

Annette Umakhihe holds an MSc in Data Science from Lancaster University, which she has employed professionally in the predictive modelling of residential building ages for property valuation in the UK and in road network and infrastructure classification for rural development in NIgeria. The latter experience engendered her interest in designining and implementing technology-focused public policy. She is now studying a double degree Masters of Public Administration and Global Affairs at the London School of Economics and the Munk School of global Affairs. She aims to advance innovative policymaking using technology and research.

Program and Research Intern

Regan McCort

Program and Research Intern

Regan McCort is pursuing a Masters of Global Affairs at the Munk School with an emphasis on global development. She also holds a Bachelors of Arts specializing in International Relations from the University of Western Ontario. She’s interested in exploring the intersections between taxation, gender, and subnational governance through her work with LoGRI.

Program and Research Intern

Megan Campbell

Program and Research Intern

Megan Campbell is a recent graduate of the Ethics, Society and Law program at the University of Toronto, and an incoming JD/BCL candidate at McGill’s Faculty of Law. Megan is invested in the relationship between political economy and postcolonial ethics. Her previous work with the ICTD includes research support for the programme on informality and tax.

Keep up-to-date

Sign up for LoGRI’s newsletter to keep up with new research, reform developments, events, job openings and research funding opportunities.