Somalia is emerging from a long period of collapsed governance; however, it is still regarded as one of the most politically unstable countries since 1991. Southern regions are still grappling with instability fueled by insurgent forces competing with the government for control over resources and revenues.

Domestic revenue mobilization in Somalia is instrumental in building the government’s capacity to finance infrastructure and development projects. Yet, tax collection performance is weak, averaging less than 10 per cent of GDP. Municipal governments across the six federal states rely mainly on central government transfers and international grants to finance their core functions and provide public services.

Garowe, the capital city of Puntland state, took significant steps in 2018 to improve local revenue mobilization by modernizing its property tax system with the adoption of an Automated Information Management System (AIMS) and the Billing Information Management System (BIMS). These systems were later replaced by the Integrated Financial Management Information System (IFMIS) and a Geographic Information System (GIS).

While these interventions have had a positive impact on overall revenue mobilization, they have not translated into improved property tax performance due to a list of key challenges detailed below.

Overview of Property Tax Performance

Prior to 2013, there was a lack of transparent revenue collection and allocation records. The prolonged conflict resulted in the destruction of physical infrastructure and the inability to keep accurate property records.

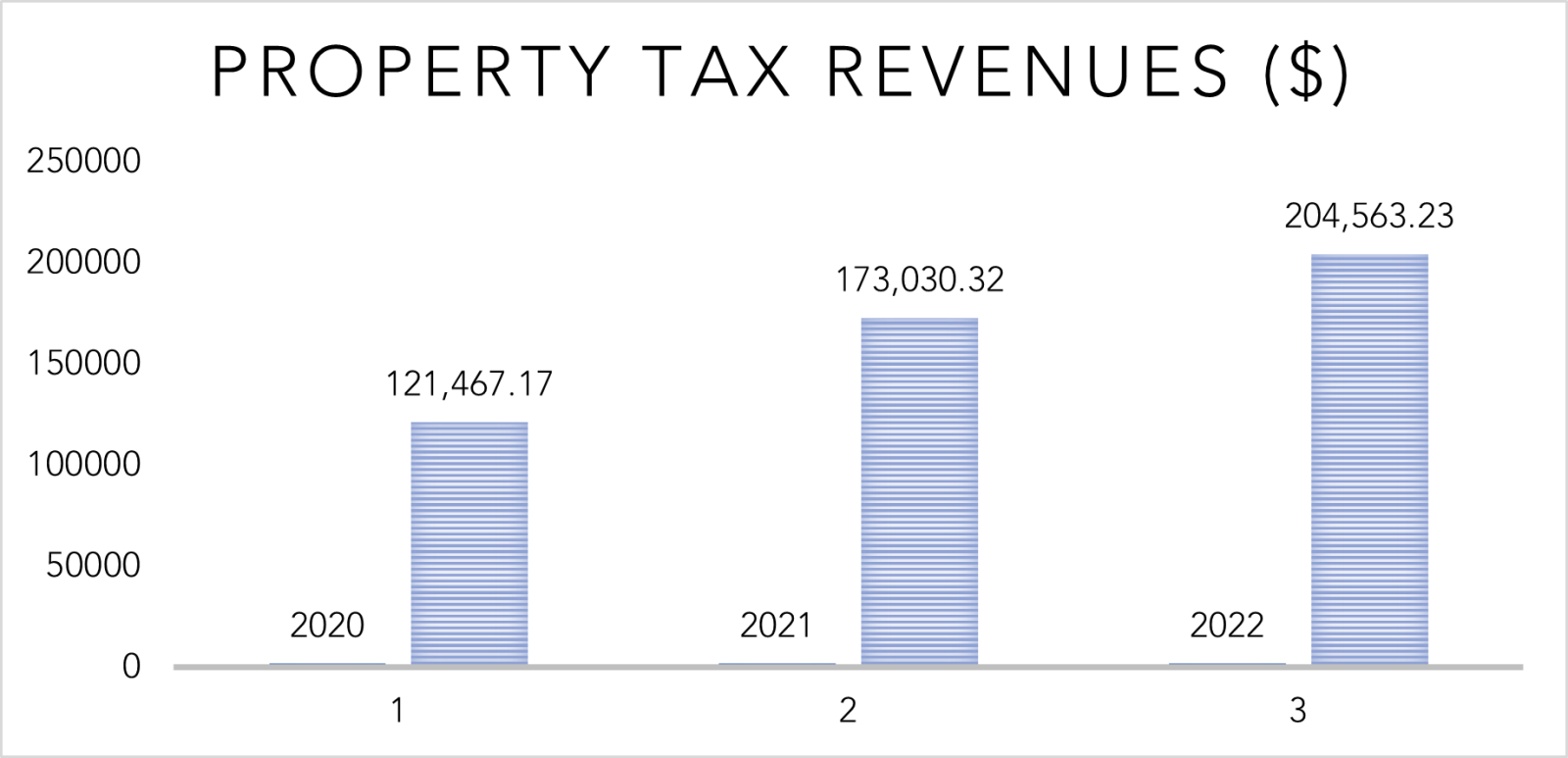

The city started keeping property tax records inconsistently in 2015, effectively mobilizing $113,000 USD in property taxes, representing 14.96 per cent of total revenues that year. Consistent record keeping started in 2020 when better accounting systems like IFMIS were introduced. In 2020, the city collected $121,467.17 USD in property tax revenues. This amount increased to $173,030.32 USD and $204,563.23 USD in 2021 and 2022, respectively.

The Remnants of Conflict and a Weak Institutional Environment Ill-Suited for Robust Property Taxation

Given the unstable environment in Somalia, there are no strong legislative or administrative frameworks governing property taxation.

The existing property tax administration guideline is an “old tax Performa,” a tax regulation used prior to the collapse of the Somali government in 1991. These guidelines are obsolete and require amendment. According to a Garowe City Council member, “local governments in Puntland have no property tax policy. Every local government in Puntland uses its own property tax base and rate, so there is an urgent need for a unified property tax policy.”

The lack of comprehensive policies has created challenges like arbitrary enforcement methods, corruption and misuse of property tax, and poor dispute resolution mechanisms. These challenges have negatively affected citizens’ attitudes and perceptions of the importance of property taxes.

Who is Eligible for Property Taxation, and How are Properties Identified?

Property tax is levied on all buildings and fenced land and is paid by the owner. This includes residential houses, commercial buildings, and semi-permanent structures. Government and religious institutions like ministerial offices, schools, health centers, police stations, mosques, and Qur’anic madrasa are exempt.

Property registration is done by a mobile team that identifies properties and updates the records. The information gathered includes the plot location, land plot size, and the name and details of the property owner.

Garowe is a fast-growing city in Somalia experiencing increasing real estate development. However, property registration has been hampered by past political instability and weak human capacity. Prior to using GIS, new properties were manually registered, with a team of municipal enumerators doing daily observations of the new structures, thus slowing down the process. Additionally, property owners with multiple properties often concealed their additional properties from the authorities.

With the adoption of IFMIS and GIS in 2020, Garowe improved property identification, registration and revenue collection. GIS is used to locate property structures and measure coordinates, while IFMIS is used to record and manage taxpayer data and tax collection. The development of IFMIS was supported by the World Bank, while GIS was initiated and run by a privately owned local company.

In 2021, the city had an estimated 30,000 taxable properties, of which 20,000 were registered, 17,000 (85 per cent) billed, and 6,000 (35 per cent) paid property taxes. This is a significant improvement from the figures for 2015, which revealed that the city had 10,000 estimated properties, where only 8,500 were registered, 2,642 were billed, and only 400 (below 15 per cent) paid the property tax. However, further efforts are required.

A Simplified Yet Imperfect Method of Assessing the Value of Properties

Property valuation is a crucial step in assessing the value of properties for tax purposes. Garowe City uses an area-based system to value properties. The method multiplies the dimensions of the property—its width, height, and length—by a constant value determined by the City to determine the tax liabilities.

The area-based system seems easy to administer but can be regressive and inequitable as buildings of the same size, but different qualities, can pay the same tax amount.

Valuation is conducted annually to ensure newly developed properties are regularly added to the valuation roll. Furthermore, the new IFMIS system automatically calculates property rates.

Limited Personnel, Facilities and Logistics, Poor Remuneration and Working Conditions.

A notable challenge in Garowe’s property taxation is the limited capacity and resources, including human resources, coupled with few incentives to motivate the staff.

The city employs 15 people to conduct assessments, record data, send bills, provide reminders to the property owners, and enforce property tax collection. This number is small compared to the large number of taxable properties (see above).

Tax collectors operate under hard working conditions, including insufficient transportation to deliver tax bills quickly in different parts of the city. Non-delivery of tax bills and weak enforcement open up opportunities for property owners to evade and avoid tax payments.

Lastly, tax collectors’ salaries amount to $90 USD per month, which is low in an expensive city like Garowe, resulting in reduced motivation and increased opportunities for corruption.

Poor Service Provision, Limited Transparency, and Accountability

Inadequate provision of public services and weak transparency have also negatively affected compliance and revenue performance. Property taxpayers expect better services from the city, but garbage collection, street lighting, road rehabilitation, and security are inadequate.

While transparency is key to promoting tax compliance, many property taxpayers in Garowe perceive revenues to be managed with little transparency and accountability. To reverse this trend, efforts have been made to share audited financial reports through municipal websites, social media accounts, and public forums like Puntland Development Research Center (PDRC) talks, in which the mayor of the city responds to the questions from the public.

Nevertheless, there is still a big challenge regarding information access and taxpayer reluctance. For example, public talks are not attended by a broad audience, as they are considered to be for the elites. Social media may not be effective as it appeals more to the younger generation, who, often are not property owners. However, community meetings may be more effective as they appeal to the property owners.

The Property Tax Situation in Garowe City Underscores Three Key Takeaways.

- Property taxation in Somalia occurs within a complex and challenging environment marked by the remnants of past political instability, insecurity, and weak capacity. These factors present obstacles to effectively administering property taxation.

- Building an effective tax system requires consistent investment over time to build capacity and trust with taxpayers – the latter requiring improved service delivery.

- Implementing outreach activities and taxpayer education programs highlighting the benefits of taxation can ultimately contribute to gathering public support and dispelling misconceptions and resistance to taxation.

Acknowledgement: With thanks to Dr. Colette Nyirakamana for supporting in writing this piece.

Photo credit to Wikimedia/Jamamd.