Since June 2023, LoGRI — in close collaboration with UC Berkeley — has been supporting the provincial government of Kasaï Central, DRC, in a comprehensive reform of their property tax system in their capital city Kananga.

At the core of this reform lays the deployment of a digital and transparent property tax system designed to increase fairness, improve efficiency, and boost revenue collection. The goal of this initiative is not only to strengthen the local government’s ability to mobilize resources, but also to lay the foundation for a more accountable and equitable public finance system in Kananga.

Property Valuation Through CAMA

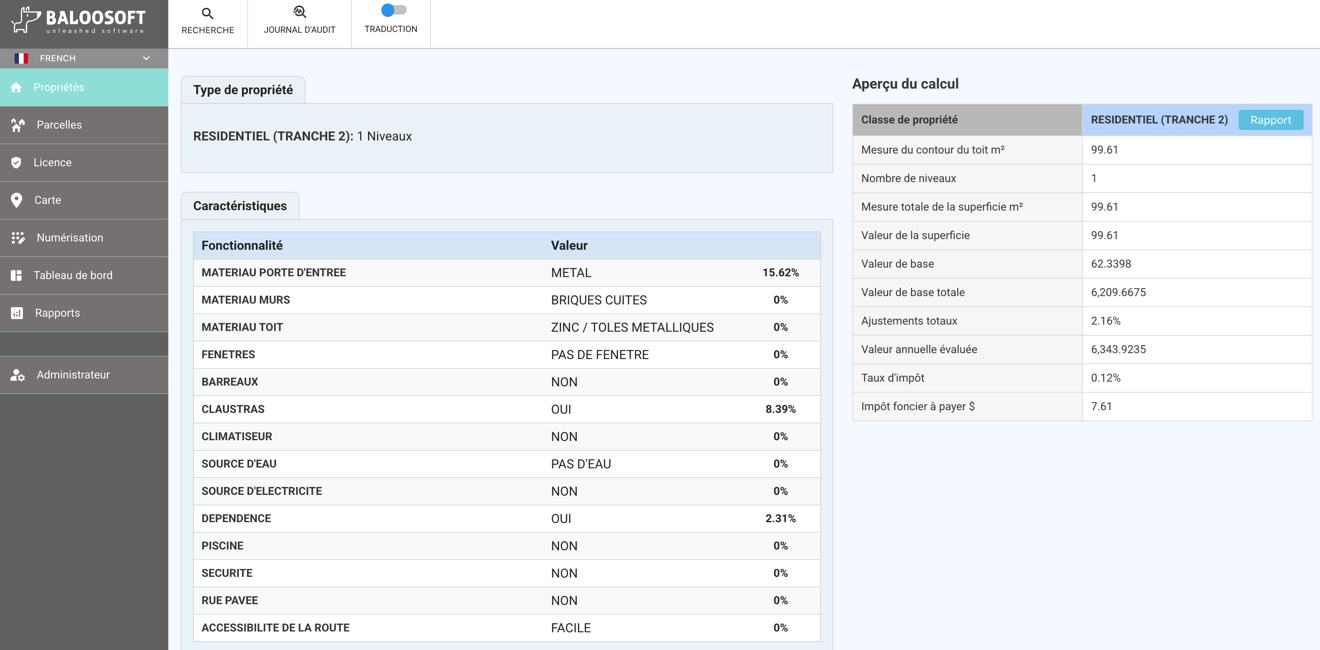

To overcome the lack of reliable market data and the high cost of manual assessments, the project introduced a Computer-Assisted Mass Appraisal (CAMA) approach, using a simplified point-based valuation method where property values are estimated based on:

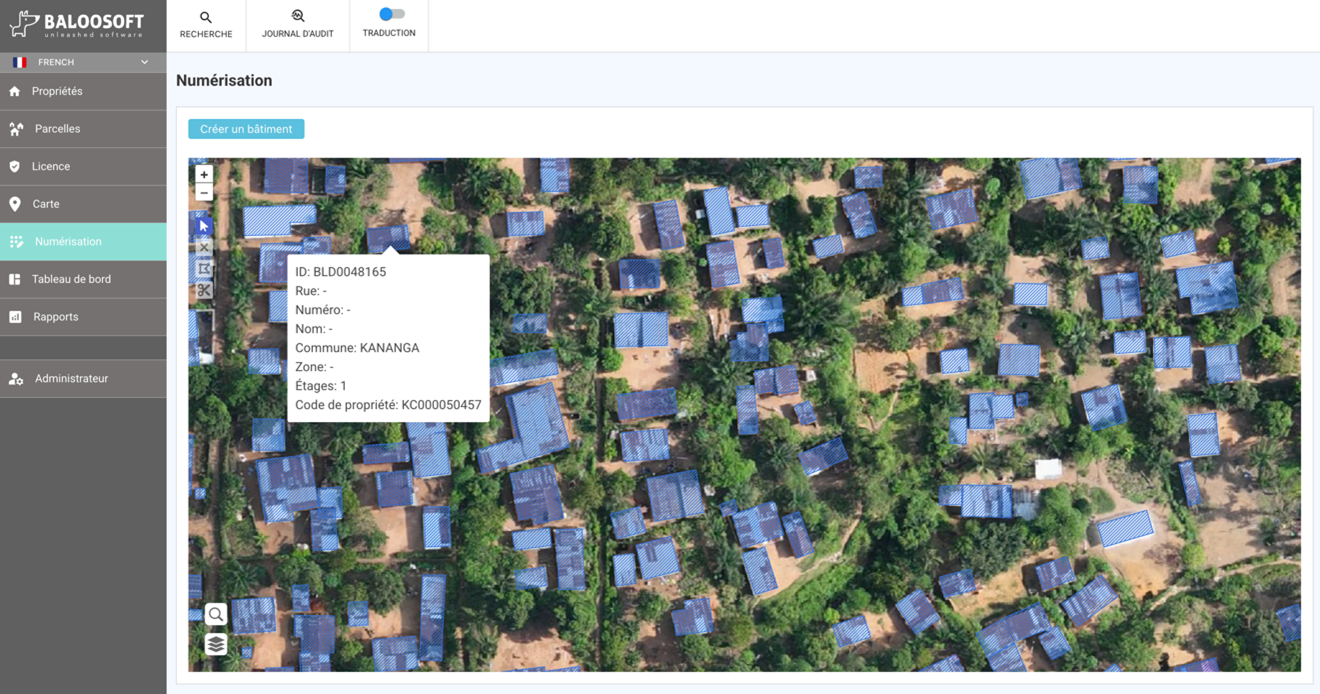

- Building size, derived from drone-captured roof area and number of floors,

- Observable external property characteristics, such as construction materials and condition,

- Geographical features, such as neighborhood location.

This method, already applied successfully in Sierra Leone, provides a cost-effective, scalable, and transparent way to estimate property values and improve equity in taxation.

Moptax: End-to-End Digital Tax Management

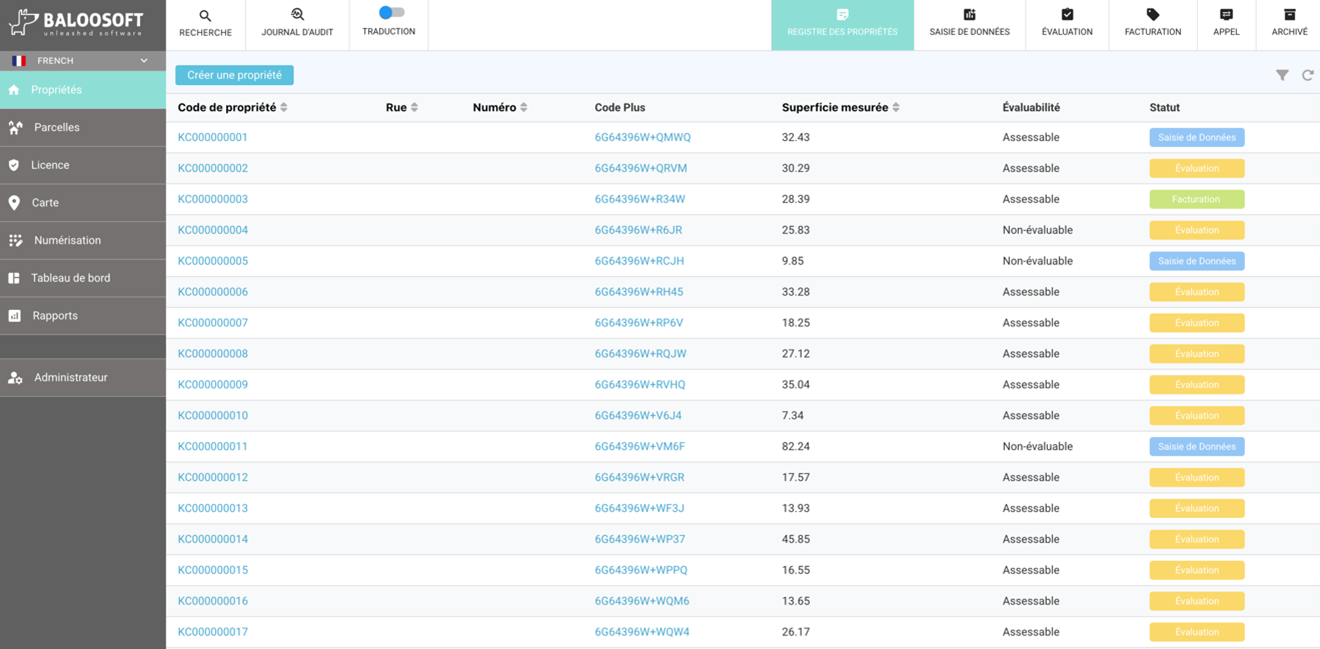

To support the entire tax cycle, Baloosoft’s digital tax system called Moptax was specifically configured for and implemented in Kananga. Moptax covers all stages of the process — from property identification and valuation to billing, payment, appeals, and enforcement. Key features include:

- A property register with automated value calculation,

- Payment integration with mobile money providers and local banks,

- Audit trails and role-based access control to ensure transparency and accountability,

- Automated workflows for billing and appeals,

- GIS integration for spatial data management and address generation using Google Plus Codes.

Moptax provides the technical backbone for property tax management in Kananga, enabling a system that is efficient, traceable, and auditable.

From Reform to Ownership: Government Handover of Moptax

In April 2025, as Moptax entered its first full year of implementation, technical consultant Xaver Schenker traveled to Kananga to conduct a high-level handover workshop with the provincial government and the Direction Générale des Recettes du Kasaï Central (DGRKAC). The goal: to ensure that local authorities are fully equipped to autonomously operate and maintain the Moptax system.

This visit marked a critical milestone in the reform—signaling the shift from externally supported implementation to full local ownership. The handover process included technical training, strategic planning for ongoing operations, and clearly defined roles and accountability mechanisms across the entire tax cycle.

Building on this progress, LoGRI project officer Adele Somat will continue to support the next stages of the transition through the end of 2025, leading to a fully autonomous, government-led operation for the 2026 tax cycle.

Learn more about LoGRI’s work in the DRC here.