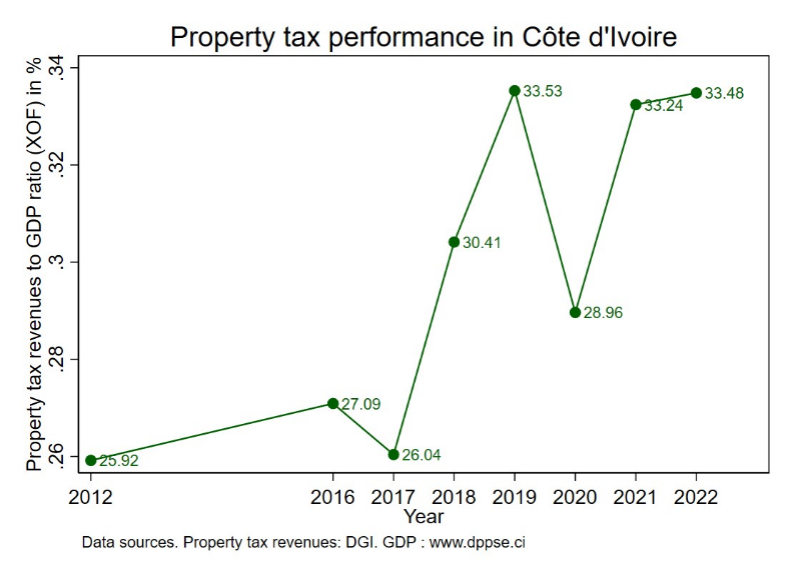

In Côte d’Ivoire, property tax revenues are shared between central and local governments, with municipalities receiving about 40% of total revenue, yet they remain the backbone of local finances, enabling local governments to fund public services. In recent years, the country has made progress in property tax mobilization, with revenues increasing from approximately 0.26% of GDP in 2012 to nearly 0.34% by 2022, as shown in Figure 1. However, despite these recent improvements, property tax continues to underperform.

A significant challenge to improving property tax mobilization lies in the current state of property identification and registration, which is managed by the Directorate General of Taxation (DGI), specifically its cadastral department (DCAD). Prior to recent reforms, these activities were conducted manually, with mapping and census data recorded on paper. As a result, property registers remain incomplete and often contain inaccurate or outdated information. In response, the DGI launched several initiatives aimed at updating property registers and capturing a greater number of properties in the system. Consequently, between 2018 and 2022, the number of plots registered by the DCAD increased by 25%.

This blog explores the strategies designed to expand the property tax base in Côte d’Ivoire, particularly focusing on projects that leverage third-party data and digitalizing processes.

Leveraging Third-Party Data

To capture more property owners and update its databases, the DGI and its line ministry launched the CORIF (Comité d’optimisation de rendement de l’impôt foncier) project in 2019, an ambitious initiative to leverage property ownership information from third parties in Abidjan. As part of the project, a private IT firm was contracted to integrate existing property ownership databases from firms such as the national water company, the national electricity company (CIE), and the building and public works laboratory (LPTP, Laboratoire du bâtiment et des travaux publics). The LPTP, responsible for certifying the electrical safety of buildings, collects crucial property information, including owners’ names, addresses, and internal property characteristics. This data is centralized in an application developed by the IT firm, integrated with the LPTP and CIE databases.

While innovative, CORIF was not the DGI’s first attempt to leverage third-party data. In the past, several firms expressed concerns about sharing their customers’ private information with the government and eventually refused to cooperate. To address this reluctance, the Ivorian government argued that it is entitled to property ownership data, since private companies like the CIE operate through public concessions – agreements that grant them the right to provide public services. To mitigate the issue, CORIF adopted an incremental approach, integrating data one firm at a time, ensuring a steady expansion of the property tax base. Moreover, integrating various databases could benefit both the government and private firms, as companies like the CIE sometimes rely on outdated information, such as records of deceased owners.

However, technical challenges have emerged in using third-party data, due to the difficulties interfacing differently structured datasets, along with the need to address data inaccuracies and cross-check multiple databases. Significant resources are spent identifying property owners, but the requirement to obtain all owner details – names, dates of birth, and more – can be questioned, as it extends tax collection timelines, complicates administrative procedures, and may result in revenue losses. An alternative is to tax properties instead of owners when ownership details are unknown, as practiced in Freetown, Sierra Leone.

Despite these challenges, CORIF presents significant opportunities once an interconnected, automated data cross-checking system is established.

Digitalization

Digitalization can play a pivotal role in expanding the property tax base by improving property identification systems and their accuracy. Several key projects in Côte d’Ivoire are drawing on digital tools to improve property registration and property tax mobilization.

a) Cooperation Between Tax and Land Administrations through SIGFU

Initiated by the Ministry of Construction (MCLU) – in charge of urban land management – the Système Intégré de Gestion du Foncier Urbain (SIGFU) aims to modernize land titling through comprehensive digitalization. All existing paper maps are being digitized and included in the MCLU’s database. Prospective property owners are also invited to submit their applications for land titles online, streamlining the process. By digitalizing the land titling process, SIGFU aims to reduce administrative steps and significantly speed up property ownership access.

Building this digital database is expected to be instrumental in identifying property owners for tax purposes, as the information will be automatically shared with the DGI. Until now, information exchanges relied on manual processes, resulting in inaccuracies and delays. The current length of the land titling process, which can span several years, further implies substantial losses of tax revenues for public authorities.

A clear strategy for integrating and interconnecting digital systems is critical to efficiently leveraging all the rich property information being collected. Ensuring seamless data flow between stakeholders, such as the MCLU and the DGI’s DCAD, will be essential for maximizing the benefits of digitalization while reducing redundancies. Through SIGFU, the MCLU, and the DGI plan to integrate their information systems to streamline property identification and registration.

b) GIS-Based Technologies for Property Identification through PAGEF and PIDUCAS

The Programme d’Amélioration de la Gestion Economique et Financière (PAGEF) is a project implemented by the DCAD, with funding from the African Development Bank. Since its launch in Abidjan in 2022, it has aimed to boost domestic revenue mobilization by improving property registries. The project incorporates tools such as 3D mapping and geo-localization to update cadastral maps and enhance property identification processes.

Similarly, the Project d’Infrastructures pour le Développement Urbain et la Compétitivité des Agglomérations Secondaires (PIDUCAS), funded by the World Bank, focuses on the rapidly urbanizing secondary cities of Bouaké and San Pedro. PIDUCAS also uses IT tools like aerial imagery and Geographic Information Systems (GIS) to facilitate property identification and registration.

These tools, such as 3D mapping and geo-localization, offer the potential to significantly improve property identification and registration for tax purposes. Updating property registries with digital mapping reduces the likelihood of errors or incomplete data, compared to paper-based methods Additionally, digital mapping tools accelerate the process of property identification and registration.

While both projects are externally funded, a major challenge will be ensuring long-term sustainability. The cost-effectiveness of aerial imagery can sometimes be questioned compared to existing satellite imagery, which may provide alternative sources of data of sufficient quality. Furthermore, it is critical to ensure that after funding ends, the data collected, and digital tools developed are fully integrated into the DGI’s workflow.

Investing in capacity building for local staff will be key to ensuring that the DCAD can independently maintain and expand these property identification and registration systems. By emphasizing this integration and capacity building, the Ivorian government can ensure digitalization efforts are on-going and self-sustaining.

Photo credit to Wikimedia/fr.zil.