Thematic Areas

In Malawi, property tax administration is a joint effort between the central government and the city councils of Lilongwe, Mzuzu, Blantyre, and Zomba, as outlined in the Local Government Act (LGA) of 1998. This collaboration involves the Ministry of Lands, Housing, and Urban Development (MLHUD), with the Ministry of Local Government, Unity, and Culture serving as the link between central and local stakeholders. The LGA informs fiscal decentralization in Malawi, guiding city councils on structuring tax rates, valuation, assessment, billing, collection, and enforcement.

Property identification is a shared responsibility between the MLHUD and city councils. The MLHUD allocates land and city councils use this information to identify taxable properties. The LGA mandates property valuation every five years by registered valuers under the Land Economy Surveyors, Valuers, Estate Agents, and Auctioneers Act, including private valuers from the Surveyor Institute of Malawi (SIM). When private valuers conduct these valuations, the MLHUD must approve valuation rolls before they are released for taxpayer review. City councils then use these updated rolls to calculate tax liabilities and issue tax notices. Payments are made through banks or directly at council headquarters, with city councils overseeing enforcement.

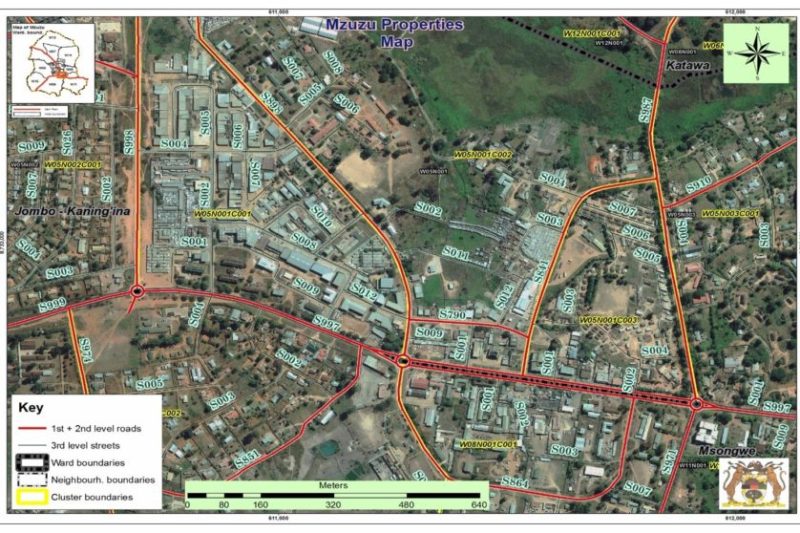

City councils in Malawi struggle with limited capacity to maximize property tax potential, evidenced by a low number of registered properties and inconsistent valuations. However, reforms are underway to improve the property tax system. For example, Mzuzu’s City Council initiated the Revenue Mobilisation Programme (REMOP) to improve property identification, assessment, and public awareness, which led to a fourfold increase in registered properties. Currently, the four city councils, with support from donors, have ongoing initiatives to improve property tax performance.

Learn more:

- Bwanali (2017): Property Taxation under Fiscal Decentralisation in Malawi https://www.researchgate.net/publication/333949625_Property_Taxation_under_Fiscal_Decentralisation_in_Malawi_What_Are_the_Available_Institutional_and_Governance_Arrangements

Featured Projects

Upcoming Publications

Related Media

Photo credit to Justin Kaunda