Où nous travaillons

L’élaboration de systèmes de fiscalité foncière exhaustifs dans les pays à faible revenu : comparaison des approches axées sur le cadastre et sur l’impôt foncier

Éléments clés de la conception de systèmes informatiques pour l’imposition foncière

Identification et cartographie des propriétés pour l’imposition foncière

Rencontrez notre équipe

Titilola Akindeinde

Directrice exécutive

Moyo Arewa

Directeur de programme

Evan Trowbridge

Responsable technique

Colette Nyirakamana

Responsable de la recherche

Marie-Reine Mukazayire

Chargée de la recherche

Kevin Grieco

Chercheur post-doctoral

Actualités et presse

Blogs récents

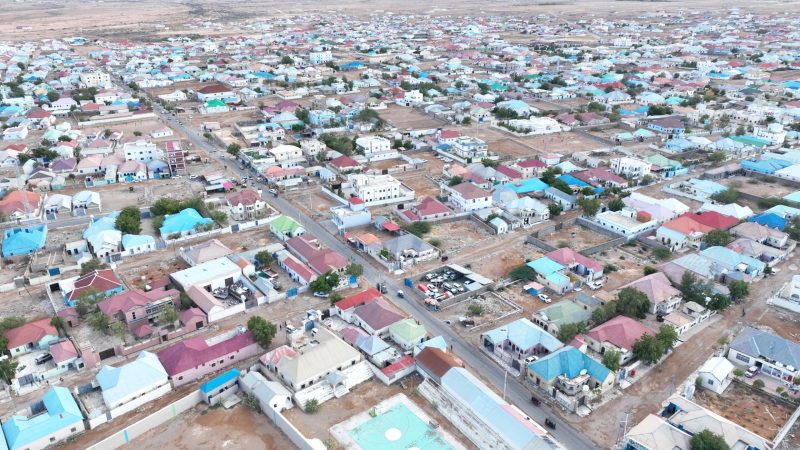

Crédit photo : Amani Nation